FHA vs. Conventional Loans for Walnut Creek Condos: What Buyers Need to Know

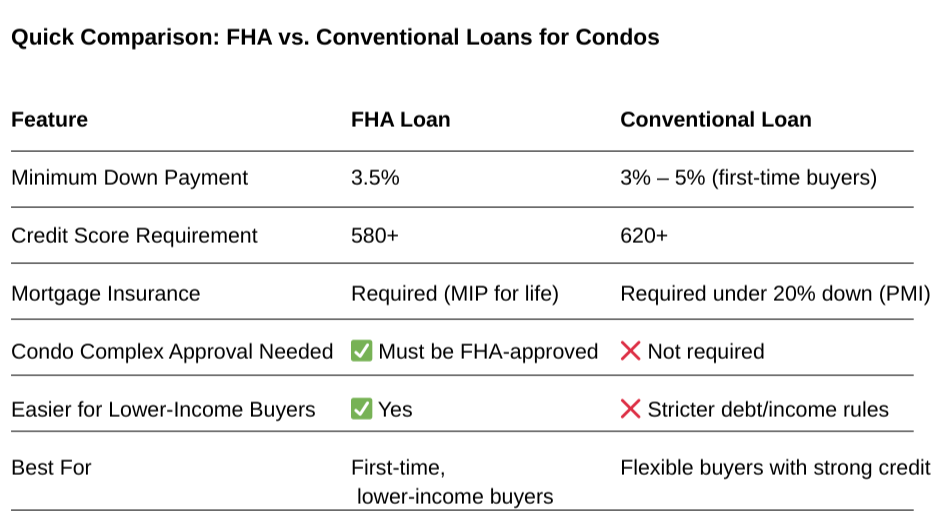

If you're planning to buy a condo in Walnut Creek, one of the biggest decisions you'll face is how to finance your purchase. Most buyers choose between two popular mortgage types: FHA loans and conventional loans.

But when it comes to condos, the choice isn't just about down payment or credit score—it also depends on the HOA and the condo complex itself. Here’s a breakdown of how FHA vs. conventional loans work for Walnut Creek condos, and what you should know before you apply.

🏠 What Is an FHA Loan?

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration. It’s designed to help first-time and lower-income buyers enter the market.

Key Features:

✅ Low down payment (as little as 3.5%)

✅ Lower credit score requirements (580+)

✅ More flexible debt-to-income ratios

❗ Requires mortgage insurance (MIP)

❗ Condo must be in an FHA-approved complex

💬 Pro Tip: FHA is great for buyers with limited savings—but many Walnut Creek condo communities are not FHA-approved.

💼 What Is a Conventional Loan?

A conventional loan is backed by private lenders and usually conforms to Fannie Mae or Freddie Mac guidelines.

Key Features:

✅ Down payments as low as 3–5% for qualified buyers

✅ No mortgage insurance if you put down 20%

✅ More flexible with condo approvals

❗ Higher credit score requirements (typically 620+)

❗ Stricter income and reserve requirements

💬 Pro Tip: Most Walnut Creek condo buyers go the conventional route, especially if the complex isn’t FHA-approved.

🏘️ Can You Use an FHA Loan for a Condo in Walnut Creek?

Yes—but only if the condo complex is FHA-approved.

As of 2025, many popular Walnut Creek complexes are not currently FHA-approved, including:

That’s why it’s so important to check the complex’s approval status early in your home search.

🧭 You can search approved complexes here:

🔗 FHA Approved Condo Lookup

📋 Conventional Loan Advantages for Condo Buyers

Many buyers opt for conventional financing because:

You don’t need the condo project to be FHA-approved

You may qualify for competitive rates with strong credit

Some lenders offer as little as 3% down on conventional loans for first-time buyers

You avoid lifetime mortgage insurance (if you put down 20%+)

💬 Even if you’re FHA-eligible, a conventional loan may be more flexible for condos.

📁 What Lenders Look for in a Condo Loan

Regardless of loan type, lenders will want to review:

HOA financials and reserves

Occupancy rates (owner vs. renter units)

Litigation involving the complex

Special assessments or pending repairs

A condo’s eligibility isn’t just about the unit—it’s about the whole building.

🔗 Related Blog Posts

💬 Need Help Finding a Condo That Works With Your Loan?

I work closely with local lenders and stay on top of which Walnut Creek condo complexes are FHA-approved, warrantable, and lender-friendly. I’ll help you avoid dead ends—and find a condo that fits your financing.

📩 Contact me for a list of FHA-approved or conventional-loan friendly condos

📞 Let’s connect you with a lender and find a home that fits your budget